How to Avoid Payroll Errors

In this article, we will talk about how to avoid payroll errors and make payroll processing easier.

Yulia

|Dec 15, 2022|The way a company deals with payroll says a lot about its management. Handling payroll process comes with quite a few challenges that often result in errors. In this article, we will talk about how to avoid payroll errors and make payroll processing easier.

Payroll problems

Human errors are very common when processing payroll. The amount of required data and calculations can make anyone’s head spin. Especially if only one or two HR, no matter how diligent and responsible, handle the payroll.

Different rates, overtime pay, late arrival fees – with these and many other things to keep in mind, under and overpay are bound to happen. While employees are very likelyto report a surprise pay deduction, not everyone will admit that payment they received is too high.

In both cases, the company takes a loss. Undeservingly receiving smaller payment will affect employee trust, motivation and overall job satisfaction. While paying for unworked hours will hurt the finances.

How to reduce payroll errors?

While it might be impossible to eliminate payroll errors entirely, there are lots of ways to reduce them.

- Optimize attendance records

Do you still use attendance sheets or punch cards to record attendance? Even though these methods might be simple and familiar, they make payroll processing much harder than it needs to be. Not to mention that they are very easy to trick.

Digitizing and automating attendance records collection can save a lot of time and money for your company.

With Clockster recording attendance is easier than ever before. Employees can clock-in and out via a simple to navigate and user friendly Clockster app.

All records, late arrivals, early departures, overtime is automatically accounted for when calculating payroll.

- Automate payroll

Payroll calculation includes many steps. Making a mistake at any point will result in the whole calculation going wrong. Automating payroll allows for more consistent, error-free results.

Clockster’s Payroll feature automatically accounts for everything: rates, taxes, overtime, holidays. You name it – Clockster’s got it. Set it up one time and enjoy automated payroll. All you need to do is review and approve payslips!

Clockster is free for companies with less than 30 employees. Try it today and get rid of payroll errors!

25

Nov

Career planning is the process of exploring one’s own potential and strengths to determine career paths. Here are tips to do it successfully.

20

Jun

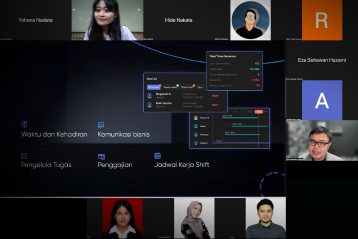

Webinar Clockster summary: How To Build & Increase Employee Productivity, June 15th, 2022 with Eza Hazami.

26

Jul

In this article we will talk about how to prevent employee burnout and boost job satisfaction with efficient work schedule management.